Invest in enduring value — empower seniors to remain at home for life.

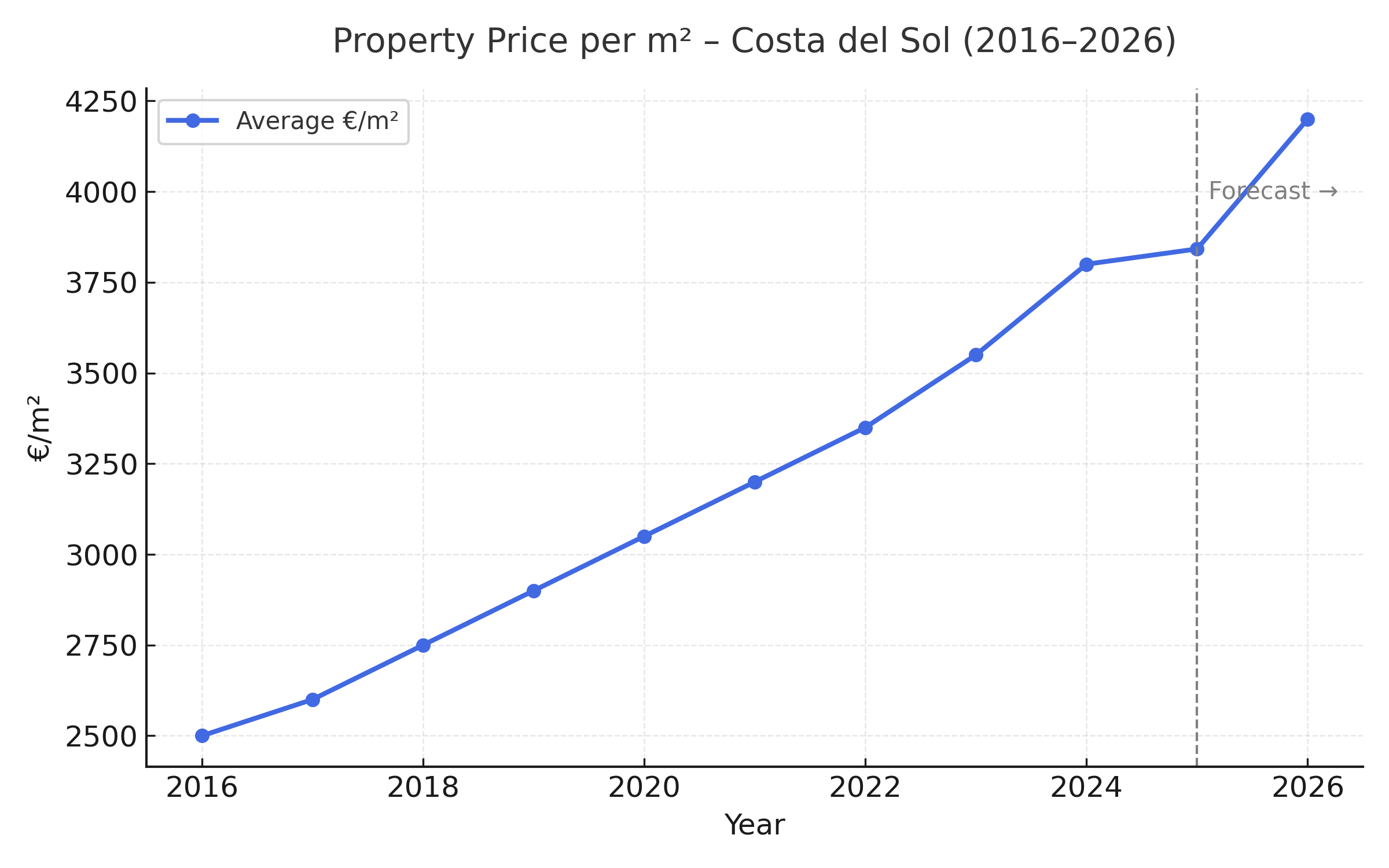

Spanish Legacy Fund acquires residential and commercial properties in Spain's Costa del Sol at a discount, granting lifetime occupancy to elderly homeowners. Long‑term returns with real social impact.